Automated Forex Trading refers to the use of computer programs or trading algorithm to carry out transactions on foreign market for exchange. The programs are designed to adhere to specific rules of trading that aim to maximize profits and minimize losses.

There are a variety of options available to choose from automated trading software. You need to find an honest one that has a track record that will meet your needs in trading.

Before you can begin automating trading, it's important to establish a trading plan. This involves identifying the conditions in which you want to trade in, establishing entry and exit points and setting stop-loss order.

You should have a risk management plan A platform for trading automated should include a system for making sure that you minimize the possibility of losses. This might include placing stop loss orders as well as restricting the volume of trades at any given moment.

It is important to test your strategy with historical data. This can help you spot weak points and make necessary adjustments.

Be aware of your automated trading system. Automated trading may be time-saving, but it's important to monitor it on a regular basis and make any adjustments that are needed.

Keep abreast of market conditions. In order to succeed in automated Forex trading it is important to keep abreast with the market and modify your strategy accordingly.

Automated Forex trading is possible only if reliable software is used The strategy to trade is clearly defined, risk management is effective and there is periodic monitoring and adjustments. Take a look at the top here are the findings on best trading platform for site info including cheapest fees crypto exchange, top automated trading systems, nadex automated trading, kraken futures trading, crypto swap sites, royal q crypto, forex auto trading robot software, best app to invest in cryptocurrency, leverage in crypto, trading on binance, and more.

What Can You Do To Evaluate The Backtesting Program For Forex When Trading With Diversgence?

The following factors must be considered when looking at forex backtesting software to trade using RSI divergence: Data accuracy: Ensure that the software has access superior historical data regarding the currency pairs that are traded.

Flexibility: Software should be flexible enough to allow customization and testing of various RSI divergence trading strategies.

Metrics: The software must provide a range of metrics that can be used to evaluate the effectiveness and profitability of RSI divergence strategies.

Speed: The software should be quick and efficient, allowing for quick testing of various strategies.

The user-friendliness. The software should be user-friendly and simple to comprehend even for those who have no technical background.

Cost: Consider the cost of software, and determine whether you are able to afford it.

Support: The program should provide exceptional customer support that includes tutorials, technical assistance and many other support services.

Integration: Software must be compatible with different trading tools like charting software, trading platforms, and trading platforms.

It is important to test the software using the demo account prior to committing to a subscription that is paid, to make sure it is compatible with your needs specifically and you're comfortable using it. Check out the best automated forex trading hints for website advice including best robot trading 2020, automated trading softtech, auto trading software forex market, arbitrage trading platform, best crypto coin for day trading, forex forum sites, gemini custody fees, robot for trading stocks, binarycent review reddit, automated trading sites, and more.

What Are The Most Important Causes Of Rsi Divergence

Definition: RSI diversence is a technical tool that analyzes the direction of an asset's price change and the relative intensity of the index (RSI). Types: There's two types of RSI Divergence The two types are regular divergence and hidden divergence.

Regular Divergence: A situation in which the asset price has a higher low/higher high as well as the RSI produces a lower low/higher low. However, it can signal an eventual trend reversal. It is essential to also consider the other factors that are technical or fundamental.

Hidden Divergence - When the value of an asset is at a lower level or lower low, but the RSI hits a higher level or lower low, it's classified as hidden divergence. Although it's a less strong signal than regular divergence it may still be a sign of potential trend reverse.

Be aware of technical aspects

Trend lines, support/resistance indicators and trend lines

Volume levels

Moving averages

Other oscillators, technical indicators, and other indicators

It is important to consider these essential points:

Economic data releases

Specific news for companies

Market sentiment and indicators of sentiment

Global events and their impact on the market

It is important to think about technical as well as fundamental aspects prior to investing in RSI divergence signals.

Signal A positive RSI divergence is an upward signal. Negative RSI divergence is a bearish signal.

Trend Reversal - RSI divergence may signal an upcoming trend reverse.

Confirmation RSI diversification should be used along with other analysis methods to confirm.

Timeframe: RSI divergence can be examined on various timeframes to get different perspectives.

Overbought/Oversold RSI: RSI values higher than 70 indicate overbought situations and values less than 30 indicate that you are oversold.

Interpretation: To comprehend RSI divergence in a precise manner requires taking into account other fundamental or technical factors. Have a look at the best read this post here for backtesting platform for site examples including automated ai trading, nadex automated trading software, thinkorswim auto trading bot, diablo 2 trading reddit, crypto trading company, ai stock trading bot free, shiba inu trading, algo robot trading, crypto trading simulator, forex signal auto trade, and more.

What Is Crypto Backtesting With Rsi Divergence Stop Loss, The Position Sizing Calculator?

Backtesting cryptocurrency using RSI divergence and stop loss is an excellent method to test a trading strategy using cryptocurrencies. It employs the Relative Strength Index, (RSI), indicator, and the calculation of sizing for positions. RSI divergence is a technical analysis technique that compares price movement of an asset with the RSI indicator. It can be used to spot possible trend reversals. It's used to limit the risk of losing a trade if it goes against your position. The position sizing calculation is a tool that helps determine the right amount of capital required to invest in a trade. It's based on the risk tolerance of the trader and their balance of the account.

Follow these steps to backtest the trade strategy by using RSI diversgence, stop-loss and the size of your position.

Define your trading strategy. These rules will allow you to make and take out trades in accordance with RSI as well as stop loss and position size.

Collect historical prices It is a method to collect historical price data on the cryptocurrency you're looking to trade. The data is available from a variety of sources, including information providers or cryptocurrency exchanges.

Backtest the strategy with historical data Utilize R to test the trading strategy. Backtesting algorithms can comprise the RSI indicator, stop-loss calculator, and position sizing calculation.

Examine the results using backtesting to assess the profitability and risk associated with the strategy for trading. If needed, modify the strategy to improve its efficiency.

Backtesting strategies for trading can be performed using R-based packages like quantstrat or Blotter. These packages include a variety functions and tools that permit you to backtest trading strategies using different methods of risk management and technical indicators.

The RSI divergence, stop-loss, and the position sizing calculator are all efficient ways to design and test a cryptocurrency trading strategy. It is essential to analyze the strategy using the historical data and then adapt as market conditions alter. View the best on yahoo about software for automated trading for blog advice including etoro cryptocurrency list, auto trade thinkorswim, best crypto day trading platform, pros binance, crypto copy trading, copy trading crypto, crypto stock app, yuan binance, etoro crypto spreads, intraday trading cryptocurrency, and more.

What Are The Main Differentiators Between The Online Trading Platforms For Cryptocurrency?

There are a variety of differences between online cryptocurrency trading platforms. Security: The most significant difference between them is their degree of security. Certain platforms might have more robust security measures like cold storage of funds as well as two-factor authentication. Others may have weaker security measures that leave them more vulnerable for security breaches and theft.

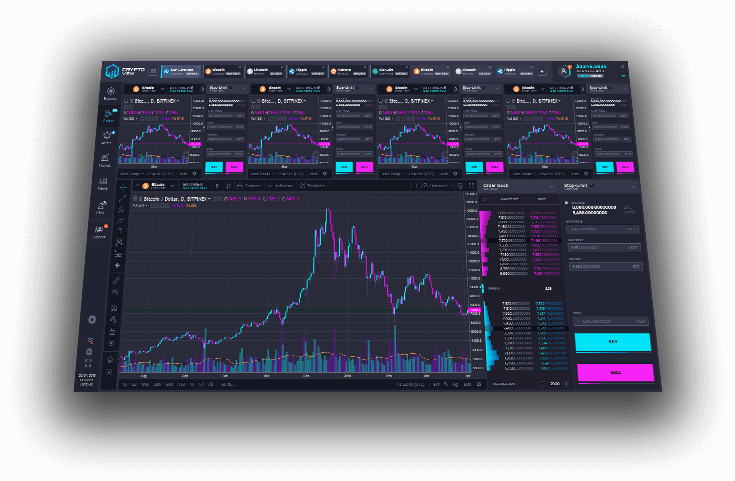

User Interface The cryptocurrency trading platform's user interface may be either simple or complex. Some platforms could offer more advanced features and tools, while others cater to those who are new to the field.

Fees for Trading. There is another difference between the cryptocurrency trading platforms. Fees for trading can differ between platforms. Some may charge more for trading, while other platforms may provide lower prices for trading options , or offer fewer trading pairs.

Accepted Cryptocurrencies Certain platforms might offer a wider range of trading options, whereas others might only support a handful of the most popular cryptocurrencies.

Regulation: It's possible for an exchange platform for trading in cryptocurrency to be regulated at different levels and types of oversight and regulation. While some platforms are more tightly controlled than others, some have no oversight.

Customer support: It's possible for various platforms to offer different levels of customer service. Some platforms offer 24-hour customer support via chat, phone, or live chat. Other platforms may limit customers to email support, or not offer it at all.

There are several fundamental differences between cryptocurrency trading platforms. These elements will affect the way traders trade and the risks they are willing to take. See the top discover more here for position sizing calculator for website tips including ripple trading platform, trusted crypto exchanges, best forex signals forum, best automated trading apps, day trading altcoins, nifty automated trading system, automated crypto trading reddit, cfd crypto, 3commas reddit, uphold automated trading, and more.

[youtube]bx_M0ax6Pv4[/youtube]